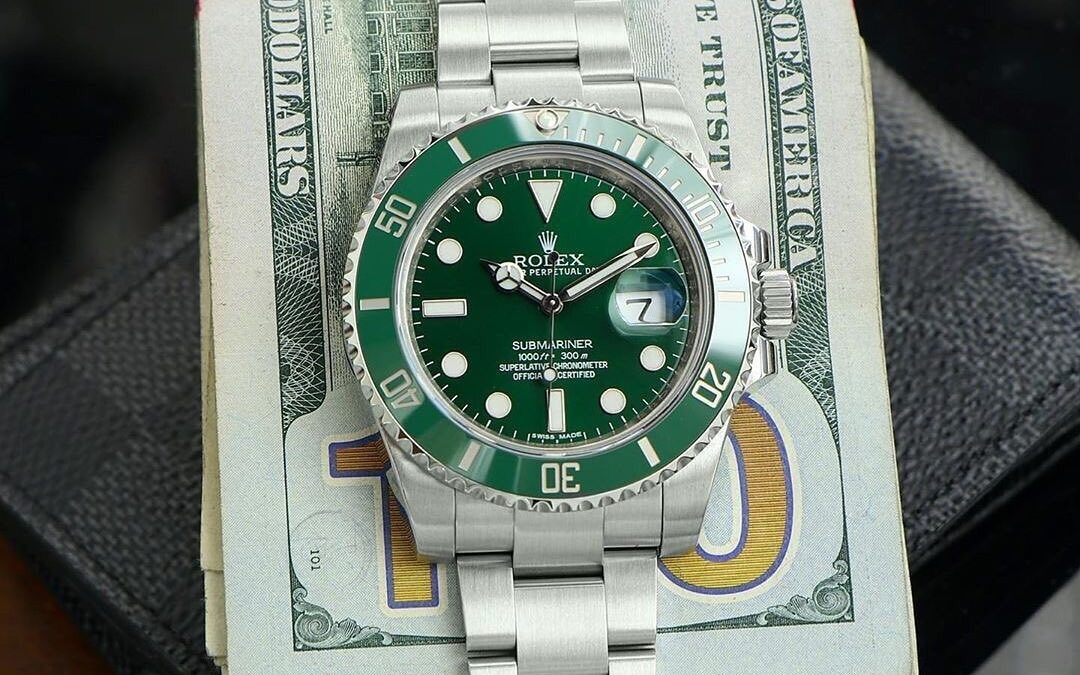

Most of us can probably remember our first significant watch purchase. Mine was almost 20 years ago, but the memory hasn’t faded. I was fresh out of watchmaking school working for a small, family-owned jewelry store. The watch was a Rolex Turn-O-Graph.

It didn’t take long for one of my new coworkers to point out the obvious: the watch I wore on my wrist was worth more than the car I drove to work. He was right, and it wasn’t even close. It also wasn’t the last joke I endured because of the disparate value of those two possessions. In the end, though, I think I had the last laugh.

A year after I purchased that watch, my junker of a car was stolen, taken on a teenage joyride, and totaled. I last saw it wasting away in a Philadelphia junk yard. In contrast, the Turn-O-Graph functions just as efficiently today and has appreciated in value.

The concept of investing in watches took on special interest to me as I transitioned from watchmaker to financial advisor. In fact, vintage and high-end watches are a very popular form of investment included in a broad alternative investment category known as collectibles. Art, wine, classic cars and even coin collections may quickly come to mind as other collectible investments.

These alternative investments are attractive because of their potential to outperform traditional investments. It may surprise many to know that a study conducted between 1985-2017 revealed that unopened LEGO® sets actually exceeded the returns of large cap stocks, bonds and gold during the same period (Dobrynskaya & Kishilova, 2022).

Finally, those little plastic bricks are atoning for all the pain they inflict when stepped on. But before you go scooping up all your kid’s LEGO® bricks, there are a couple key points to keep in mind when considering an investment in any type of collectible.

Are You a Collector or An Investor?

Not all collectors are investors, and that’s okay. Investing in a real asset requires an entirely different mindset than simply collecting it. I didn’t purchase my Turn-O-Graph as an investment all those years ago. Instead, I was primarily drawn to the watch’s craftsmanship and style. The fact that it appreciated in value was a bonus, but I would have also been just as happy with it had its value declined.

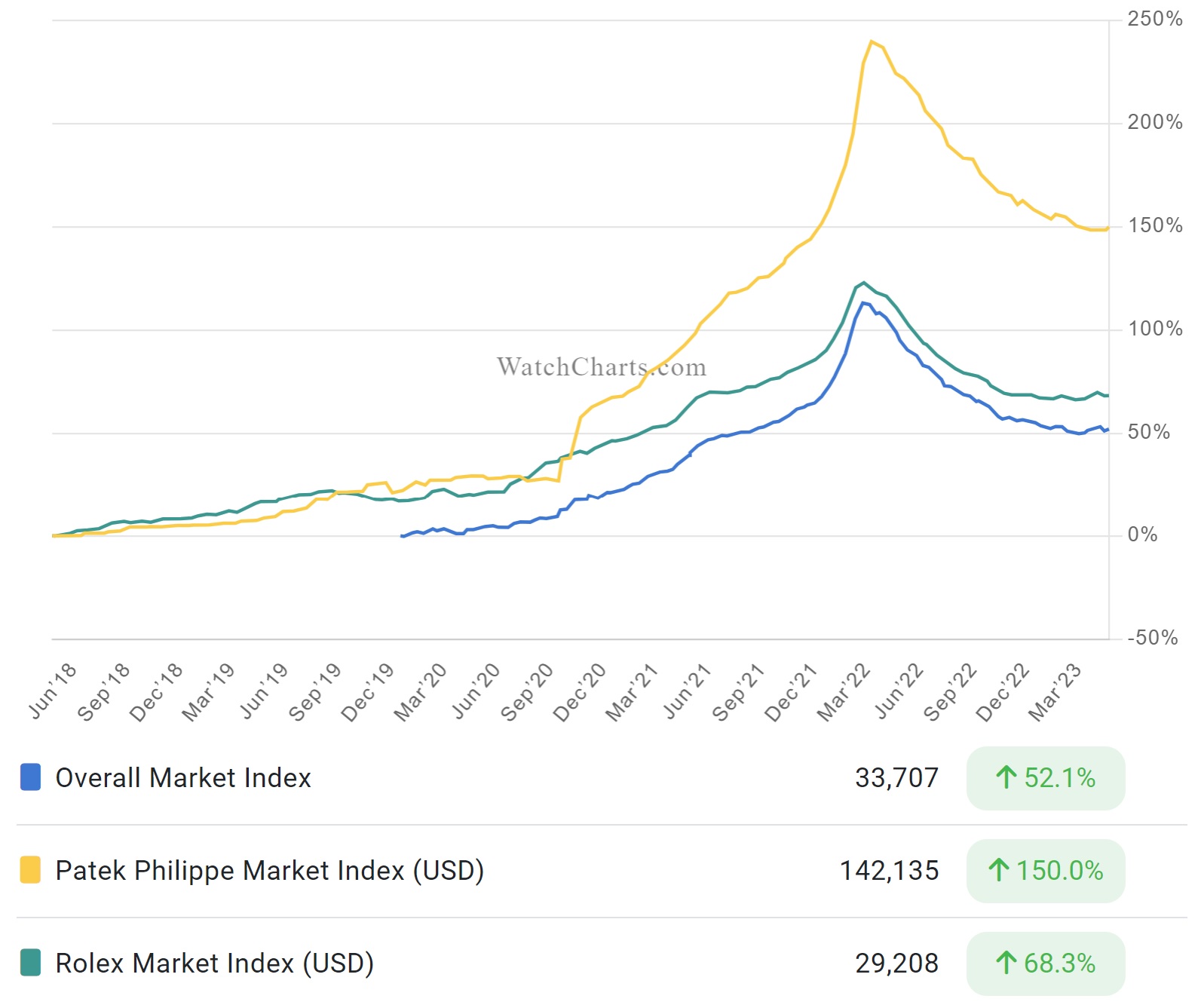

Investors, on the other hand, care a great deal about a watch’s value, which is an important differentiator considering the price volatility that often accompanies alternative investments. This volatility can be seen in the graph below showing the price fluctuations of an overall watch market index with that of Patek Philippe and Rolex over the past five years. Appreciation of style and craftsmanship won’t lessen the sting of a 20% – 30% drop in the watch market or any particular watch.

That’s not to say watch investors can’t also appreciate and enjoy their investments in much the same way a collector can. In fact, provided you can stomach the inevitable door jam collisions, watches offer a unique combination of enjoyment and potential future returns. These two outcomes don’t always operate in tandem. Sampling a wine collection, for instance, is quite literally draining away potential profit.

To differentiate themselves from collectors, watch investors need the mental fortitude to weather market volatility while not getting too attached to their inventory.

Know the Investment

A good rule of thumb for investors is to never invest in anything you don’t understand. This is the very reason I don’t invest in art. I can appreciate it, but my understanding of art mostly begins and ends with the pictures my six-year-old posts on our refrigerator.

Priceless, I know, but there’s not currently a lucrative secondhand market for refrigerator art.

Navigating a collectible investment’s secondhand market can be tricky, and watches are no exception. Fortunately, there are several tools that can lessen this barrier. In addition to auction houses, online marketplaces and watch forums, secondhand watch prices can now be tracked through the rise of market indices similar to those we see for the stock market.

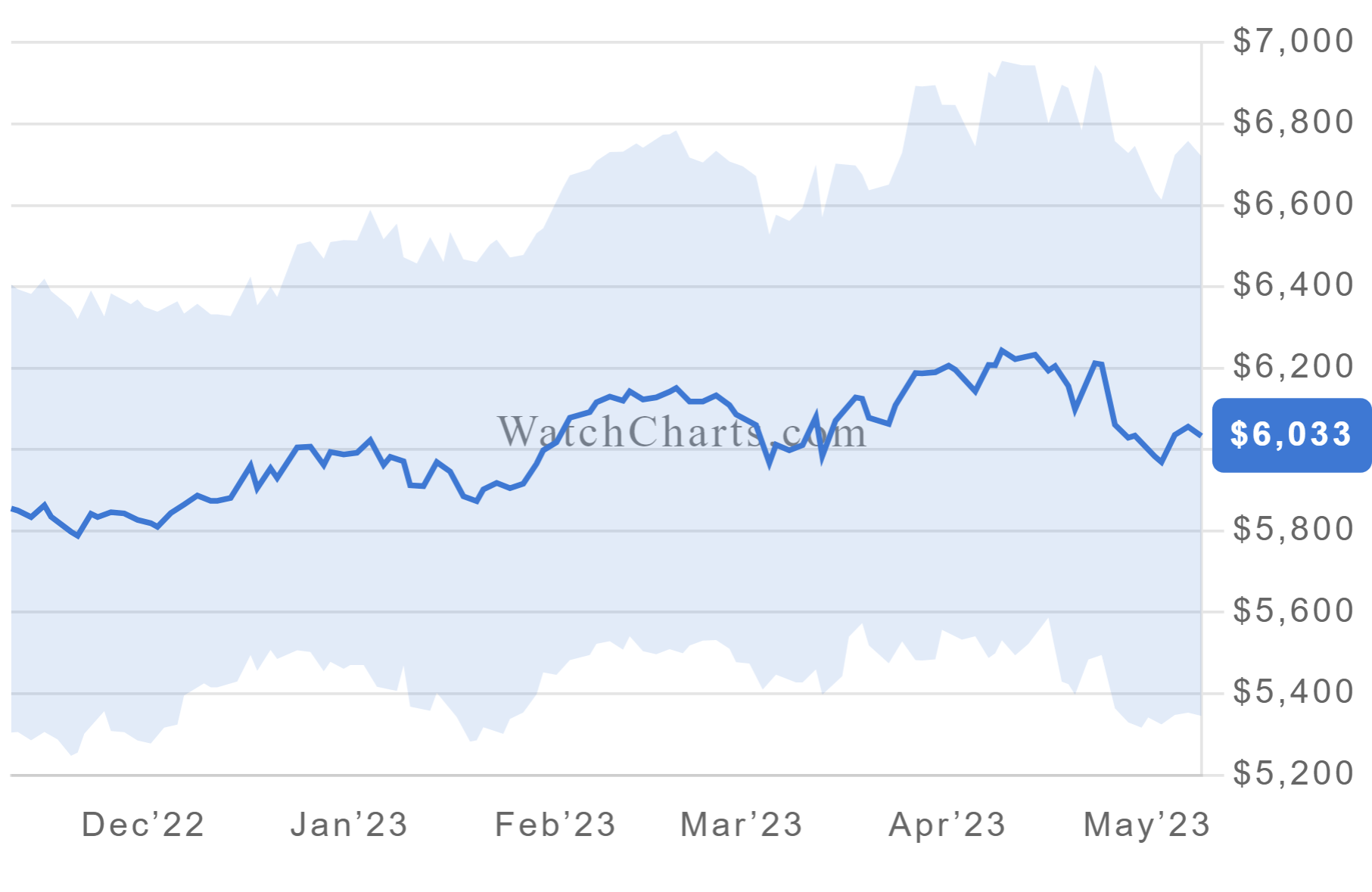

WatchCharts, for example, tracks the secondary watch market using 60 watches from the top 10 luxury watch brands. The site allows users to track the performance of watch companies and even individual watches against the overall market index. Refer again to the image above of the overall market index overlayed by Patek Philippe and Rolex returns over the previous 5 years, and the chart below showing the price history of an Omega Speedmaster.

Additionally, WatchCharts offers instant appraisals and an online marketplace. Similarly, Subdial is an index that tracks price movements of the 50 most traded watches while offering digital collection management, insurance and trading. WatchCharts and Subdial are mentioned here for informational purposes only. It is not a recommendation and investors should conduct their own due diligence when using features on either of these platforms.

Create Diversification, Not Concentration

Watches provide an opportunity to invest in something we enjoy, but combining a passion with long-term growth potential often leads to over-concentration in one investment. As with all collectibles, watches should be viewed as an alternative investment. They’re not meant to be a core portfolio holding.

To avoid going overboard, don’t invest an amount greater than you’re willing to lose. For most investors, this means keeping an alternative allocation to no more than 10% of an overall investment portfolio. The volatility of collectibles makes it imperative to incorporate them into a disciplined investment strategy that allows them to add diversification with the goal of lowering overall investment risk.

Time is money. Just as watches can be valuable investment assets, the time it takes to build and maintain a strategic investment strategy that includes them, is valuable too. If you’ve determined that you have an investment mindset, but are unsure how it fits with your existing investments; or if you need help in developing a strategy, please don’t hesitate to reach out.

And if the thought of slamming an expensive investment against a door jamb keeps you up at night, you can always invest in LEGO®!