A Noxious Weed

If you’ve spent any time in the southeastern United States, you’ve probably come across Kudzu. The epitome of a noxious, invasive species, Kudzu is a dense, fast-growing vine that spreads at an astonishingly 2,500 acres or more each year. It is known for over-growing, smothering and even uprooting native plants and trees. And yet, despite its destructive nature, Kudzu was intentionally introduced in the US in the 1930’s in an effort to mitigate soil erosion.

As inflation remains stubbornly high, it can be argued that our government introduced this destructive financial form of Kudzu through pandemic relief efforts. Basic economics will tell you that inflation results from a nation’s money supply growing at a faster rate than goods and services. In hindsight, three rounds of stimulus aid (leading to an increase in money supply by trillions of dollars), in conjunction with supply chain issues and worker shortages (leading to declines in goods and services), created fertile ground for the inflationary entanglement we’re caught in today.

Rapid Growth

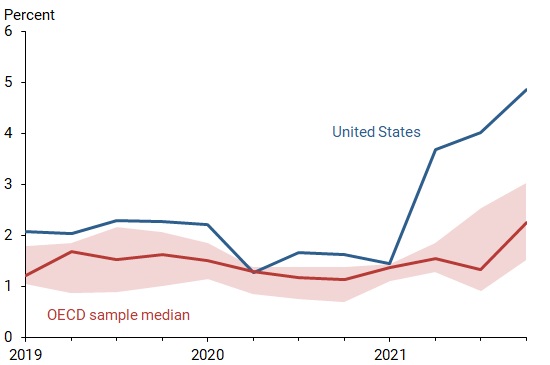

Consider the chart below from the Federal Reserve Bank of San Francisco (FRBSF) comparing US inflation with the Organization for Economic Co-operation and Development (OECD) countries of Canada, Denmark, Finland, France, Germany, Netherlands, Norway, Sweden, and the United Kingdom). Generally, inflation trend lines track closely between these developed countries, but here we see a spike in US inflation relative to the other OECD countries. The spike directly correlates to an increase in US disposable incomes due to the greater stimulus measures enacted in the US. In fact, FRBSF research estimates US pandemic relief measures added 3 percentage points to the total inflation rate by the end of 2021.

A primary issue with the stimulus payments is that they sacrificed efficiency for expediency. They were merit-based rather than need-based as payments were predicated on income levels rather than actual financial hardship. They were also used as political currency with both major parties promising or declaring support of stimulus measures to drive turnout in major elections. The result was more individuals receiving stimulus money than actually needing it. We know this more clearly now by how the money was used. A survey conducted by Betterment found that 46% of the stimulus payments were invested, either in part or entirely, in the stock market.

Who Has It Helped?

Years ago, I read the book When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor… and Yourself. While not speaking directly to governmental fiscal policy, the premise of the book is clear: sometimes, our best intentions do more harm than good. A year after the final stimulus payments were issued, they are likely hurting the very people they were meant to help. The inflationary vine that sprouted is smothering household wallets with higher prices and uprooting savings with new economic measures meant to curb it.

Inflation hasn’t been bad for everyone though. Ironically, one of the biggest beneficiaries of stimulus induced inflation is… government. The state of Pennsylvania, for example, recently reported the highest revenues ever collected, and is on pace for a $5.5 billion fiscal year surplus. Much of that record setting revenue is derived from 6% sales tax and $0.576 per gallon gas tax revenues bolstered by inflated prices.

A government employee recently joked, “Inflation is the best tax increase government never had to pass.” Years earlier, another government figure, Ronald Reagan, quipped “The nine most terrifying words in the in the English language are, ‘I’m from the government and I’m here to help.’” When it comes to “free” stimulus payments, we may have been promised a money tree, but all we’re left with is inflationary Kudzu.