There’s a particular house in my neighborhood that always catches my eye. I’ve jogged past it for 12 years but it still makes me smile. Rather than employ mulch or landscaping pebbles, the owners opted to literally encase their flower beds in concrete: creating a veritable concrete garden. Small, circular outlets in the concrete bed allow for a few strategically positioned ornamental bushes.

The benefit to this oddity is pretty apparent. No weeds! What plant is going to break through this impenetrable barrier?

Of course, this approach is not without a few drawbacks. The garden misses out on the bursts of color from late winter crocuses and early spring flowers. Regardless of changing seasons, there’s little variety. Aside from the replacement of one dying bush and an occasional concrete touch up, the garden hasn’t experienced significant change for over a decade.

What you see, is what you get. No flexibility. No variety. No change. The prioritization of a low maintenance, weedless garden comes at the price of attractiveness that variety provides.

The allure of security in a defined outcome is a strong human motivator. So much so, that we even create concrete financial gardens for ourselves. A range of products from stock funds to annuities and other insurance products, frequently trade full market participation in return for defined outcomes.

State sponsored 529 Guaranteed Savings Plans (GSP) can also be included in these concrete gardens. As their name suggests, these plans seek to replace market unpredictability with certainty.

Pennsylvania’s GSP assures its account owners that, “Your savings grows based on the rising cost of college tuition. If you save enough for a state school semester today, you’ll have enough to cover a semester at that type of school in the future – no matter how much tuition goes up.”

To promote their college savings plans, PA began reserving $100 for each child (PA resident) born since January 1, 2019. As long as a PA 529 account is opened and funded for the child, PA places the $100 in a GSP account for them.

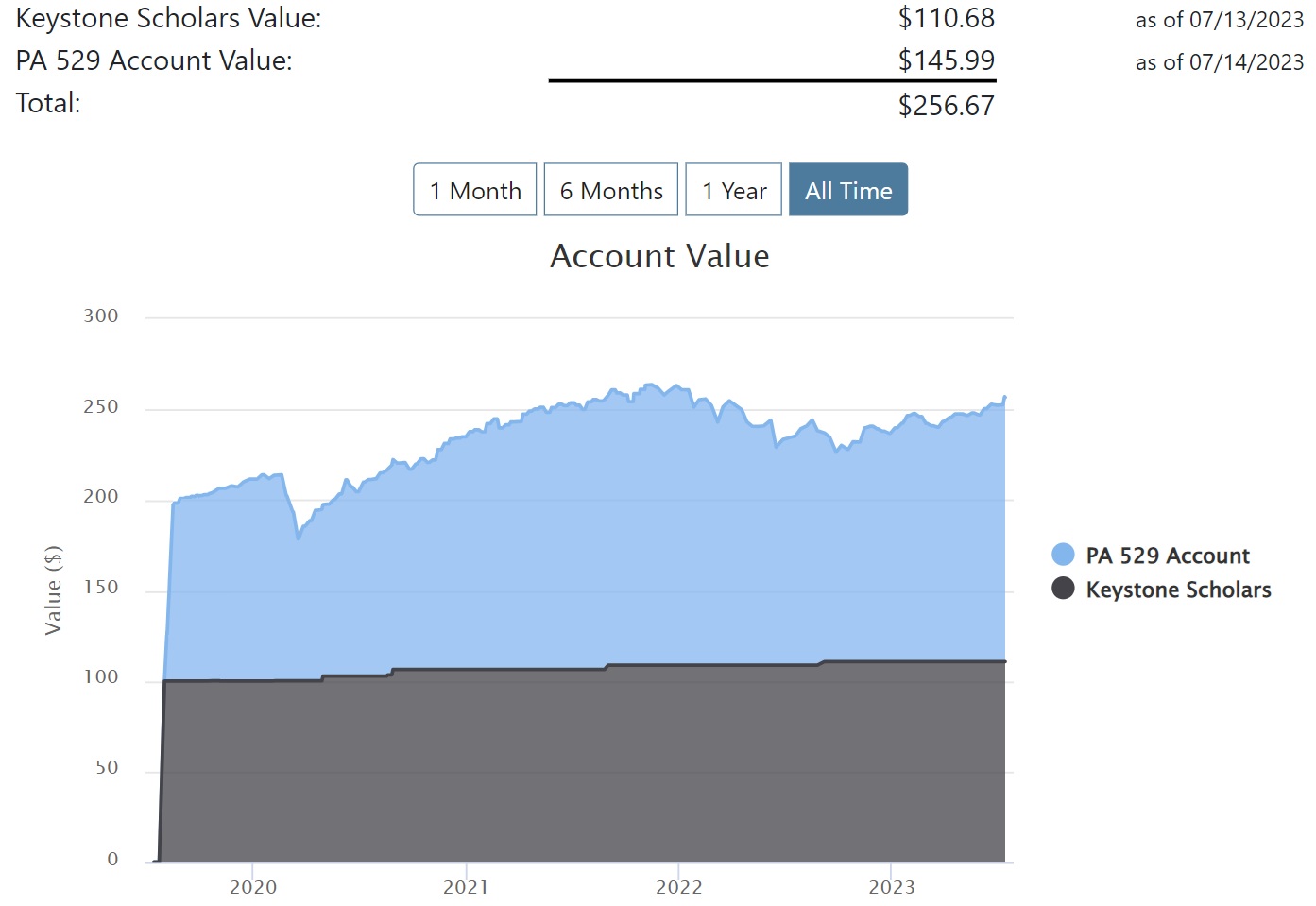

I saw this as a great teaching opportunity for my kids to track the investment growth of two very different approaches over time. It is, after all, an educational fund, right? In 2019, I opened a traditional PA 529 Investment Plan and invested $100 in a totally equity (stock) fund. PA, in turn, placed $100 in a GSP account.

Below, you can see the results of these accounts today. The light blue portion represents the investment account and the dark gray is the guaranteed account. Recognize the Covid dip in 2020 and market decline in 2022? Despite these two significant declines, the investment account has substantially outperformed the guaranteed account.

There are certainly instances where guaranteed investment approaches are appropriate, but investors should be wary of too eagerly paving over their financial gardens. Like their botanical counterparts, concrete investment gardens have drawbacks. These often come in the form of high fees or penalties, loss of investment control, limited accessibility (low liquidity), poor inflation protection (due to underperformance or capped growth) and reduction in the ability to leave an inheritance.

As seen above, the opportunity for additional 529 savings is traded for the security of knowing how much college your savings are guaranteed to buy. An investment plan, on the other hand, allows for the possibility to save excess that can then be credited to another child or even used for other savings needs.

Do you question when it makes sense to pour the concrete or leave the ground fertile in your own financial garden? If so, schedule a brief, complimentary introductory call to see how we can help.