As an avid runner, I was thrilled when my oldest child expressed an interest in running an organized race with me this year. Bud is five years old, so we made a goal of completing a 5k together. Our training culminated with running a Turkey Trot on Thanksgiving Day. We stopped short of wearing turkey costumes, but didn’t stop short of the finish line.

As proud as I was of Bud’s accomplishment, running with a five-year-old forced me to reshape personal performance expectations. It also prompted me to revisit the connection between physical and financial fitness. This correlation is an intriguing concept that I’ve written about in the past.

The Connection

In their book, “The Next Millionaire Next Door,” Thomas Stanley and Sarah Stanley Fallaw found that millionaires, on average, exercise twice as much as non-millionaires. The significance to financial fitness lies not in the actual amount of time spent exercising, but in the habit of consistently building intelligent behaviors into a daily routine.

On his blog, Of Dollars and Data, Nick Maggiulli builds on this connection with the idea that exercise correlates to wealth building by “earning” us more time. He points out that exercise contributes to longevity and estimates that every hour of exercise adds approximately 6-8 hours of disability free living to the end of our lives.

“If you can get more time,” Maggiulli writes, “you can use that time to save more money, earn more returns, and catch up financially.”

There’s very little to argue with here. A disciplined, healthy lifestyle is a tremendous contributor in building wealth over a lifetime.

Taking It A Step Further

Maybe it was the fact that the baby I used to push in a jogging stroller on my runs was now running 5k’s beside me, but these conclusions rang somewhat hollow as I thought about them again this year. Financial fitness isn’t about wealth building alone. Financial fitness also necessitates addressing wealth legacy.

As it turns out, one of the easiest ways to lose wealth is to leave it to your kids. An incredible 70% of wealthy families lose their wealth by the next generation. Ninety percent disappears by the third generation.

Successful transfers of tangible wealth at death necessitate the transfer of intangible wealth during life. All too often, though, time spent building wealth takes precedent over time spent preparing a successor generation to handle that wealth.

Training for a 5k this past year wasn’t merely reinforcing disciplined behavior and “earning” more time. It was earning me uninterrupted time with my son. Time isn’t just a means to build a fortune, it is a fortune. Unlike money, it doesn’t transfer at death, and these one-on-one runs with Bud created prime opportunities to transfer intangible wealth.

Setting A Target Pace

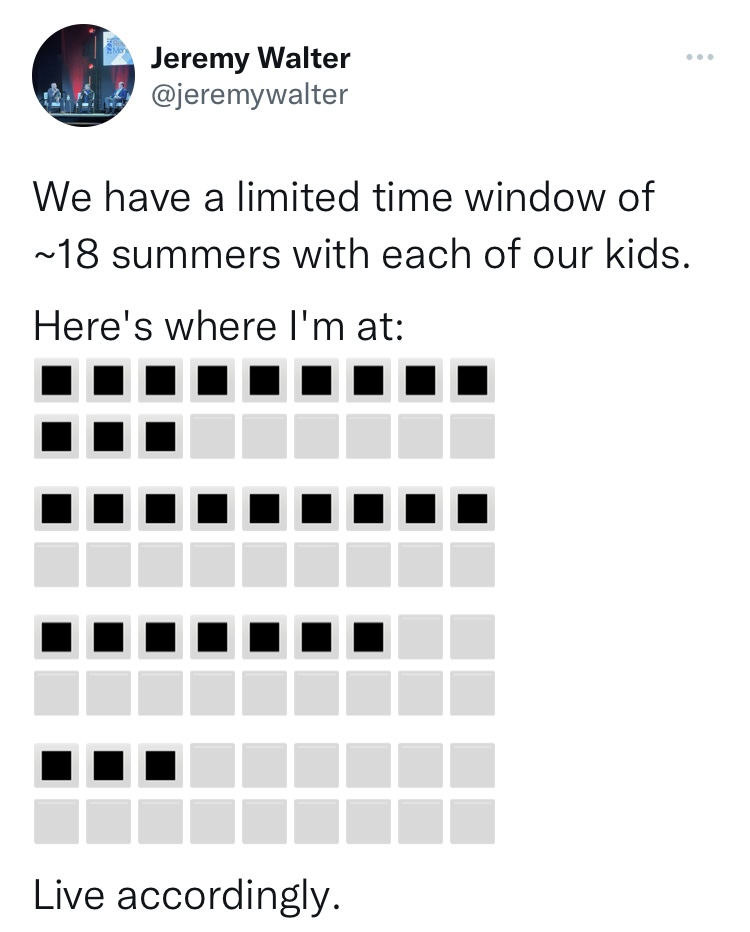

A tweet from a fellow advisor earlier this year came to mind as I thought through this topic. In a simple but powerful graphic, Jeremy Walter summed up the tension between the value and the diminishing utility of time.

The end of one calendar year and beginning of another often marks the time when financial and fitness goals are revisited. As you look ahead to 2023, don’t miss opportunities to make lasting investments of time.

Diehard runners could look at my Turkey Trot finish and wonder how I lost so much time compared to previous years. They’d be missing the wealth of time I gained. Sure, running with Bud won’t put me on the winner’s podium anytime soon, but the day that he outpaces me is rapidly approaching, and the 30-some minutes we spend running together now is pure gold.

Wise Counsel Brother! Thank you !

Congratulations to Bud and to you. Well done!